I have been with KeyTrade bank since 2016. Today I moved the last of my cash there out of my account. I started with their Keyplan and I liked that it was a way for me to invest automatically without having to worry about the market. As I wrote in my portfolio update last month I decided to sell my Keyplan. In addition to that I felt the time was right to make a bigger decission and change broker.

disclaimer “Investing involves risks of losses”

What is the Keytrade keyplan?

Ok maybe one step back. Those who followed my portfolio update must have noticed that I had a Keytrade Keyplan in it every time.

High level its described like this:

You basically create an account, choose some funds you want to invest in and just sit back and watch the automated investing go. I chose the following funds, and invested about the same amounts. Bellow you can see the, quite dissapointing, performance over the last 4 years. And this during the biggest bull run in the stock markets history

| Keytrade Funds | Start | Total | Tot P/L | Profit |

| Invesco funds invesco pan European Equity fund A | 30/04/2016 | 2800 | 215 | 7.68% |

| Franklin Templeton Investments Funds Franklin Euro Government Bond Fund A | 30/04/2016 | 2117 | 60 | 2.83% |

| BL Global Equities B | 30/04/2016 | 4311 | 803 | 18.63% |

| BlackRock global funds new energy fund A2 | 30/04/2016 | 3871 | 797 | 20.59% |

| DNCA Invest Evolutif B | 30/04/2016 | 3858 | 140 | 3.63% |

| Uban Global High Yield solution C | 30/04/2016 | 3967 | 319 | 8.04% |

| Total Keytrade Funds | 30/09/2019 | 20924 | 2334 | 11.15% |

As you can see the performance here was really horrible. None of the 7 funds managed to beat simple low cost index trackers. It did made me a profit, in some funds even a really nice profit, but mainly I made the funds managers a really good profit. Most of these funds are charging around 2% yearly costs. A cost that would be justified if they managed to beat the index, but they have not, and some have performed extremely poorly.

I always preach that nobody can predict the stockmarket. You might think that you can and you might have some short time gains, but over the long term you are not able to. The only funds I am somewhat happy with the performance is BlackRock global funds new energy fund A2 and BL Global Equities B. In my opinion they just made a successful gamble. Well semi-successful as even these could not beat any index trackers.

But why leave keytrade bank?

As I would be re-investing the money back into the stock market I had now the chance to change brokers if I wanted. Otherwise moving brokers could be expensive, but now most of the money would be on my account just sitting there.

The only other stock I had started investing in was my Vanguard SP500 Index tracker. I was super happy with this tracker, the performance was amazing and it gave some nice dividends. BUT dividends are taxed at 30% in Belgium when they come from an Index tracker. Some index trackers re-invest the dividends into the tracker. Only if you sell the tracker you need to pay some taxes (I believe about 1.2%), but this is nothing compared to the 30% you pay on the dividends every year, especially knowing I plan to keep my index trackers for at least 20 years and possibly forever.

So even that tracker I would really need to sell if I wanted to move my portfolio more to my ideal index portfolio.

For customer service, application and website of Keytrade bank I really have no complaints. These were all excellent. What bothered me more was costs. I invest about 2300-2500 EUR every month in trackers on the Amsterdam stock market and Keytrade bank charges about 7,5 EUR for that. If I would want to split this up into 2 investments each month, it would cost me 15 EUR.

Just as a reminder, I do need a broker that I can trade the Index trackers on that I am looking for. So this was a requirement:

| Portfolio | % |

| SPDR MSCI World UCITS ETF (SWRD) | 69 |

| IShares Core MSCI EM IMI UCITS ETF (CEMU) | 16 |

| IShares Core EURO STOXX 50 UCITS ETF (CSX5) | 10.3 |

| IShares Core S&P500 UCITS ETF (CSPX) | 4.7 |

Why I chose DEGIRO

I tried Lynx in the past. Lynx is a little bit cheaper then Keytrade bank but their interface is absolutely horrible. I worked in IT for about 10 years but had a lot of trouble to figure out the interface. Usability was not something that was in their dictionary.

But what if there is a broker out-there who does have a great website and app, and charges a lower cost. I started comparing and found out that DEGIRO only charges 2 EUR + 0.03%.

Assuming 12 trades per year average Keytrade bank would charge me 90 EUR while DEGIRO would only charge me 33 EUR. So a difference of 57 EUR per year that I would save every year. If I would double my trades I would even save 114 EUR. Plus only recently DEGIRO has lowered the amounts they charge, that shows me they are serious about remaining competitive.

I have not dived into all the other brokers, but did find an article from last year in a Belgian newspaper de tijd where they compare brokers in terms of costs, and also in their article (with the old prices of DEGIRO), DEGIRO comes out on top in terms of costs:

Please note that DEGIRO is not available worldwide, but they do have many countries in Europe where you can find them, and they are still expanding.

How is DEGIRO’s interface?

Costs is not the only thing that counts. As I mentioned I got lost in Lynx overcomplicated interface. At the time Lynx was the cheapest broker in Belgium.

After creating anaccount I clicked around and must say that it took me as good as zero effort to find my way. The overview screen is very intuitive and it turned out to be very easy to find information on trackers. This is how I also found out that DEGIRO is offering all trackers that I needed.

DEGIRO also allows customers to buy once a month a tracker for free, but I noticed that these are trackers that charge higher yearly costs. No matter as I said its only 2.7 EUR per transaction of 2500 EUR (even a little lower if you trade smaller amounts).

Adding cash to your account

Before beginning you will first need to write some cash to your account. DEGIRO allows two approaches:

- A fast direct transfer at the cost of 1 EUR using SOFORT

- A normal transfer from your bank account

I tried out both. With SOFORT I could not actually use only my mobile phone to do this. Only on a browser I could actually pay.

The bank transfer is easy and allows me to send my automatic monthly transfer I usually set, but it took in total 5 business days. The second time it was a bit faster and took just 4 days. There was some confusion about a second account I made to make some screenshots for here that probably delayed the process for 1-2 days.

I generally would suggest to do the bank transfer since you can automated. I put in an automated transfer once a month right after I got my wage. The purchase itself cannot be automated, which does leave some emotion that everyone can face.

For example when I heard about the Corona virus I delayed my purchase in Emerging markets ETF for a few days. Those days the markets in China closed and went down 8% when they opened. I was lucky to buy under market value like this and they bounced back up not much later. But it was a gamble. For all I knew it would just remain stable. Even after I still thought if I should not postpone the purchase for 1-2 months until the Corona virus cools down. But I just cannot predict if it will go up or down. Nobody can, and right after I bought it indeed went back up. I could not have predicted that.

Buying your first ETF

Once you have some money on your account you can buy your first ETF. I found it incredibly easy to do a purchase there.

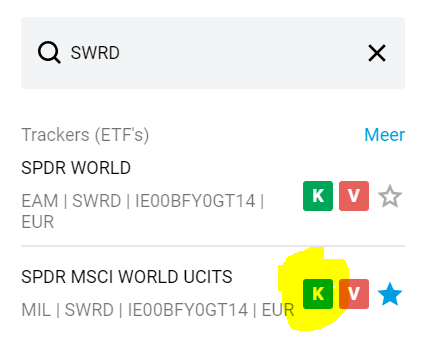

You search the ETF you are interested in:

Before you decide to buy an ETF rememember to check the documents:

Unfortunately the link was infact not working when I checked so I had to go to internal sources. I informed DEGIRO about this issue.

Things to pay attention to is costs and if they hand out dividends or not. Once you are convinced you got the right ETF or stock just click the buy button.

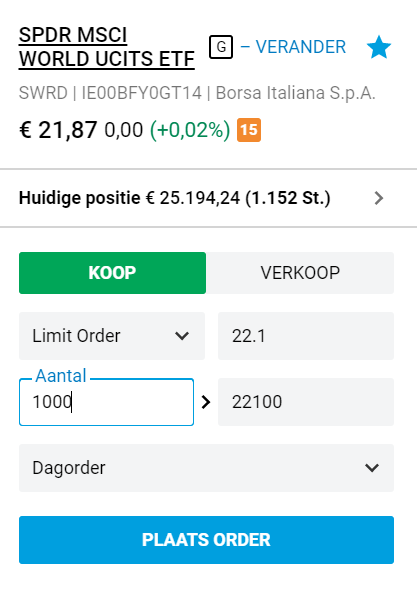

Then you need to enter how much stock you want and the limit. The limit is the max buy price you want to buy a stock for. Usually you need to pay a little bit more then the current value of the stock.

Once you filled in the limit you can click place order (=Plaats order). In the final screen you get a last overview of the exact costs. This includes both the costs of DEGIRO and any tax you might need to pay.

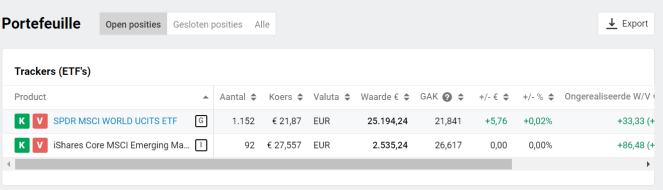

After that DEGIRO will do the purchase. This could take some time, if it takes to long perhaps you set your limit to low. Usually it should be processed within 30 minutes. Once its complete you will be able to see it in your Wallet (=Portefeuille).

I purchased two funds, exactly the funds I have told I would get in my perfect ETF portfolio blog post.

The funds I bought are SPDR MSCI World UCITS ETF (SWRD) and IShares Core MSCI EM IMI UCITS ETF (CEMU). Later I will be adding IShares Core EURO STOXX 50 UCITS ETF (CSX5) and IShares Core S&P500 UCITS ETF (CSPX) to this collection later, but they carry a lower weight in my portfolio.

Interested finding out why I chose these? Then read my perfect ETF portfolio blog post. I practice what I preach so that is why I purchased the ETFs mentioned there.

I will be leaving these ETFs here untouched for over 20 years. Or who knows perhaps forever. Its always good to think about a very long investment horizon when you invest.

Is it a risky investment? Yes whoever tells you investing carries no risk is lying or delussional. But ask yourself this question: what do you think the world will look like in 20/30/40 years? If like me you can see companies investing big in life changing technologies such as AI, self driving cars, cultures meat, curing cancer, green energy, job automation, nanotechnology, … and you think the world will go trough huge changes because of this, can you then really afford to be not in the stock market? Can you afford to see the world evolve and wait at the sideline? I am not saying you should put everything you have in ETFs. You should absolutely spread your money over different types of investments. But you should not stand back and watch at the sidelines while the world evolves.

How can you start investing in ETFs?

- Do your own research: find out what the tax situation is in your country. This is extremely important as it can have a huge effect on long term. Find out what type of investments are right for you. It might be that the tax situation is so horrible that investing in stocks is not even an option. Although this is unlikely. If your country is not taxing dividends then dividend ETFs might even be better for you!

- But once you did your research you can sign up for DEGIRO here. Its so easy to make an account and to start investing!

disclaimer “Investing involves risks of losses”

Interested to learn more and go along on my journey? Then sign up and follow me!

Hallo, viel me op dat je SWRD koopt in Milaan en niet in Amsterdam. Wat is het verschil? Groeten Hans

LikeLike

Ja dat klopt, dat is gewoon omdat je enkel deze kan kopen op DEGIRO, ik denk niet dat er een is die in Amsterdam gelist is eigenlijk.. Aangezien het bedrijf in Ierland ligt die hem uitbrengt denk ik dat het qua belastingen niet uitmaakt

LikeLike

Ja dat klopt, dit is de enige die ik op DEGIRO kan kopen, vandaar

LikeLike

Hi! I live in Belgium and have been unable to open an account with Degiro. They “no longer have a service in Belgium”. How did you do it?

Thank you!

LikeLike

Hi Kieran, normally using the links you can register. Try to use the Netherlands to register, it should work fine

LikeLike

this was sponsored by degiro, looking at the link you provides

LikeLike

Hi Jerome,

Thanks for your comment, yes I was a DEGIRO affiliate in 2020.

I didn’t move because of this but because the tarrifs are the lowest & the interface and app is really user friendly.

Our partnership ended, I will update the links, but I still stand 100% behind this post and I have all my ETFs with them.

LikeLike