Investment update in March

I usually post the first of the month. Due to events that I will explain in the blog I took a bit more time.

This is now the second month in a row I need to report bad news. The stock markets have continued to drop, although at the time of writing it does seem that for the moment the worst part is over, or at least the steepest drops. For sure they will keep dropping for a while.

The peer to peer platforms are suffering heavily and are facing massive withdrawals. The worst news for me was that Grupeer stopped processing withdrawals. Because they also stopped processing withdrawals that were on Users accounts it is now very clear that they did not separate investments from the users with their own. There is now plenty of signs that Grupeer might have put out fake investments on their website and might have been at least partly an elaborate scam. Its very difficult to believe Grupeer right now, and as I do not feel confident they still tell the truth I am gathering with some other investors to sue them.

Another consequence of this is that I decided to fully withdraw from peer to peer. Peer to peer has been since September the driving course of this blog, however I do not feel confident anymore that I can make the right investment decisions in peer to peer. Of course it will take time to get out of all the platforms as they are quite longer term investments, I will try to sell off what I can but it can take a few years. In any case I will keep track of that here for at least some time.

While my stocks have dropped a lot more in value they have never kept me awake at night. Kuetzal did when it turned out to be a scam and so has Grupeer. I have underestimated the platform and liquidity risk that are tied to these investments. Even if there is good platforms outthere, such as Mintos and PeerBerry certainly are now, since nothing is regulated and the investments are long term, they can change course in 6 months and your money will be stuck.

I will need to think on if I would then organise this blog differently or not, perhaps I will be giving my savings rate update together with this post? I have not yet decided.

My Portfolio

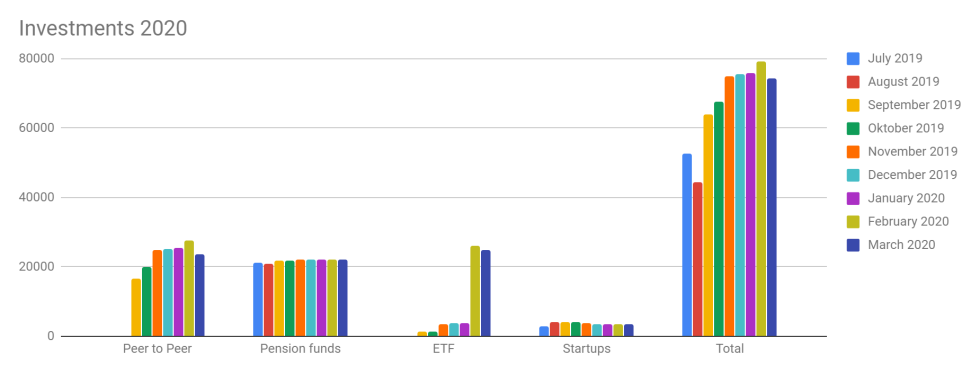

With the stock market that moved back and me going to the Cash Market with my peer to peer investments my Portfolio saw a drop to 78171 (-4910). And this includes me investing an extra 2500 EUR into the stock market. I will probably keep moving what comes free from peer to peer to the stock market.

The idea was to reduce the percentage of my peer to peer portfolio simply by investing extra in ETFs, however this is not an easy task when the stock market collapses. At least withdrawing from peer to peer will speed up this process.

And now:

Lets look into more detail for each of these investment types shall we.

Peer to Peer

I will no longer keep track of the income I am getting into peer to peer. Instead I will be showing the withdrawals here. I will sell on the secondary market where possible, but without giving huge discounts.

| Portfolio | Start | Total at 29/02/2019 | Left in the account now | Expected end date |

| Crowdestor | 30/09/2019 | 2974 | 2974 | 07/02/2022 |

| Grupeer | 30/09/2019 | 8990 | 8990 | Considering legal procedure |

| Iuvo Group | 31/12/2019 | 224 | 173.98 | 22/09/2022 |

| Kuetzal | 30/09/2019 | 1005 | 1005 | In Legal procedure |

| Mintos | 30/09/2019 | 9982 | 8282 | 07/03/2024 |

| NeoFinance | 30/09/2019 | 1273 | 68 | 01/09/2024 |

| PeerBerry | 30/09/2019 | 2548 | 2094 | 05/09/2022 |

| TFGCrowd | 30/09/2019 | 1434 | 1210 | 17/09/2020 |

| Total | 30/09/2019 | 28430 | 24796.98 | 09/12/2023 |

- CrowdEstor: I cannot withdraw anything and CrowdEstor has stopped giving interest while Corona is raging. An understandable decision, but I hope it will be over by the end of summer.

- Grupeer: Withdraws are no longer possible and it looks like I will need to resort to legal procedures

- Iuvo Group: Iuvo has a secondary market. I hope to sell a few loans there

- Kuetzal: I am in a legal procedure, while I cannot comment on it, so far I have a positive feeling about it

- Mintos: Mintos has a good running secondary market. I put my loans there at a discount of 3-4% right now. Right now they have been selling and I can withdraw around 200 EUR per day. Mintos did announce it would add a secondary market tax of 0.85%

- NeoFinance: selling went really fast here, I have just one investment remaining. I was really worried here before since some of the investments ran until 2025. I was never a big fan of NeoFinance, I always had negative returns onthere, but at least they are honest, you have a bank account and the secondary market is functioning excellent

- PeerBerry: There is no secondary market, I might need to hold it out until 2022. But its a good platform so I hope it will be ok

- TFGCrowd: I have mostly short term projects, so if the platform does not fail I will be able to withdraw everything by September

ETFs

| ETF Portfolio | Start | Total | P/L March | Tot P/L |

| SPDR MSCI World UCITS ETF (SWRD) | 31/01/2020 | 22851 | -3362 | -7214 |

| IShares Core MSCI EM IMI UCITS ETF (CEMU) | 28/02/2020 | 1918.38 | -331 | -536 |

| Total ETF Portfolio | 30/09/2019 | 24769 | -3693 | -7750 |

My ETFs have had another crazy month with huge losses, at the same time I do feel the worst drops have passed by now and it will start to stabilize in April. I will continue to invest 2500 EUR in my ETFs for now.

I guess this blog will become a great example of what happens when you start to invest in ETFs right before a crisis!

SPDR MSCI World UCITS ETF (SWRD)

My World ETF has taken another hit. Still I will continue to add EUR here every month, as right now they are a lot cheaper, and since I buy every month I do like to buy cheap!

As you can see the drop was also (slightly) less steep then last month, so perhaps this is a first sign that it will stabilize

| SPDR MSCI WORLD UCITS | Total Portfolio | Monthly P&L | Total P&L |

| 31/01/2020 | 25160.41 | 0 | 0 |

| 28/02/2020 | 23674 | -3852 | -3852 |

| 03/31/2020 | 22851 | -3362 | -7214 |

ISHARES CORE MSCI Emerging Markets IMI UCITS ETF

| ISHARES CORE MSCI Emerging Markets IMI UCITS ETF | Total Portfolio | Monthly Profit | Total P&L |

| 31/01/2020 | 2448 | 0 | 0 |

| 29/02/2020 | 2249 | -205 | -205 |

Startups

I hold 3500 EUR in startups. I started investing in 2017. This is a long term investment, but I do hope that I will see some return on it at some point.

Retirement funds

I decided not to update my retirement funds all the time since for most of the funds I get an update just once a year, so I will update it also just once a year. This is from end of 2019. I will update it again in December 2020.

| November 2019 | Current Value |

| KBC Pension funds | 7999 |

| First job Pension plan | 1467 |

| Second job Pension plan | 592 |

| Third job Pension plan | 12084 |

Wins / losses this month

- My ETF Portfolio made 3693 EUR loss

- My peer to peer portfolio is facing stormy clouds as I might have to write off Grupeer like I did with Kuetzal

- So in total my worst month so far!

The blog

- The views of my blog have dropped to 1730. This has mainly to do with the fact I blog less about peer to peer, and more about the stock market. At the same time I do get more traffic from search engines right now and I can see that my search ranking is rising slowly but certain

What is next?

I will search harder for a house, and I do hope that because of the crisis the prices will drop. I actually almost found the perfect house this month. I hesitated and didn’t made an offer. What a mistake! I hope that next time I can decide faster, but for now I will need to wait until people are allowed to sell again. Its very hard to predict right now what the effect on prices will be!

I will also post a savings rate update soon! Subscribe and make sure you don’t miss any of my monthly portfolio updates!

in your opinion, where does all the interest in the peer 2 peer lending (hence the high number of visitors) come from?

LikeLike

Until peer to peer is regulated on a European level we need to trust the word of the platforms, that they come from the borrower. Im sure there is platforms outthere where this is currently the case but for me its hard to distinguish between the real and the fake

LikeLike

It really sucks when your plan doesn’t work out. I had the same with Forex. All the effort and money you put into it gets lost.

Good luck with unwinding it all and with all this legal stuff.

At least with your ETFs, as long as the world isn’t ending you will recover since trackers are so broad. There is always light at the end of the tunnel.

P.S.: Your hotels.com referral link(/image) isn’t working.

LikeLike