Previous blogs: Setting my FIRE number: when can I retire early? (2020)

In 2020 I made a first attempt to update my FIRE number, I was not really sure how to calculate it yet, as there was no sure way to calculate this in Belgium. Most calculation models are based on a US model where people need to save themselves fulltime for their retirement. In Belgium the situation is a bit different, as we have three pillars for our retirement

What pillars do I have?

The 3.5% rule

Before starting I just wanted to give a quick recap on what we call the 3.5% rule. Actually a lot of FIRE blogs will stick to the 4% rule, but the 3.5% rule is actually a lot safer. It assumes that the stock market will go up every year on average with 3.5% + the inflation rate, giving you enough money to survive every year. You will not have to worry about the stock market going up or down, as it usually does, but instead you just take 3.5% of whatever is in your portfolio every year and survive on that. That should be small enough to have an ever-lasting portfolio.

My state pension

If the law does not changes I will get my state pension at 67. This is the age that the government wants people to retire. There is an online app called mypension.be where you can actually see how you get at the retirement age.

While many European Countries give a pension this pension only comes at a late age. In Belgium its 67! It might be that by this age the age has moved back again. You shouldn’t take the risk to let the government decide on when you can retire. At the very least you need a backup plan.

But assuming that everything is going like they tell me now I will get a pension at 67. The height of this pension is depending of how much taxed you paid and mostly how long you worked. Additionally you can buy off educational years (up to 4) that you studied. This is quite cheap if you do it within the first 10 years after graduation, but after that becomes expensive fast. Its especially useful if you plan to retire before 67, if not then its probably not so useful for you. I have bought off these years for this reason.

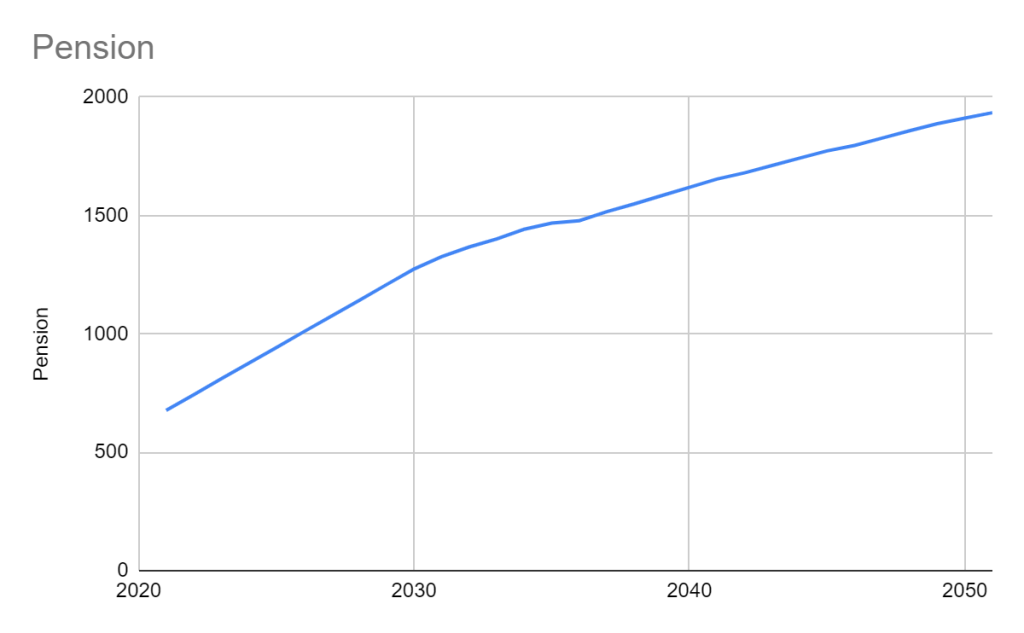

My pension looks like this, it means the longer I wait to retire, the higher my pension will be.

You can see that if you work until 67 that even then the retirement money is not so high, only 1934 EUR, unless you own a home it will not be enough to have a comfortable retirement, especially since you will have more medical bills and probably more staff such as house cleaners since you can do less yourself. In other words, additional funds will be needed. So that means even if you do not plan to FIRE you really should start thinking about how you will manage when you retire as the state pension will most likely not be enough.

In case you want to do the simulation yourself (as a Belgian citizen), you can do this on mypension.be

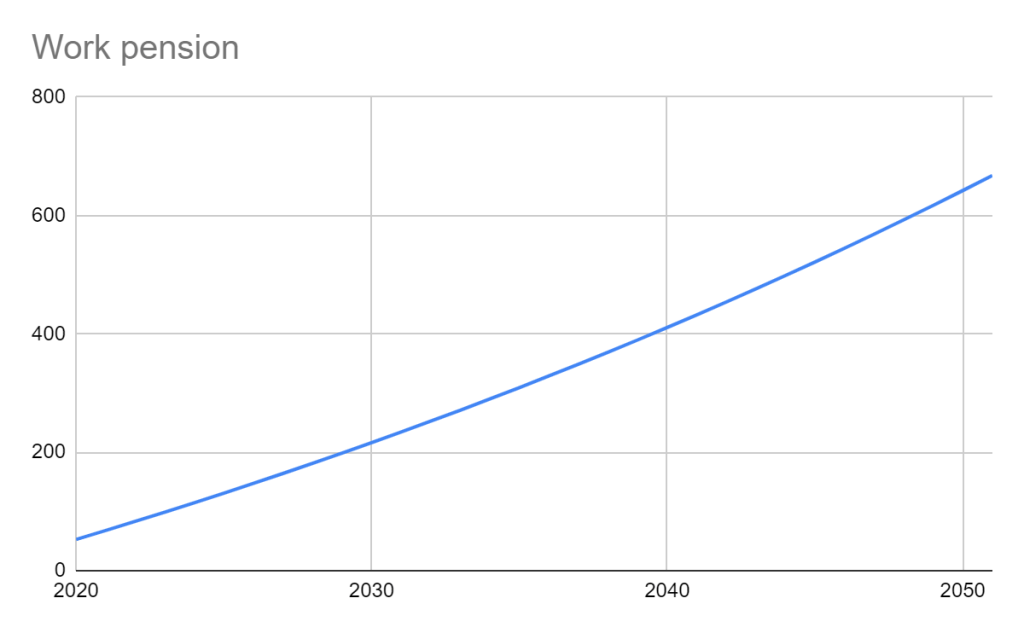

The second pillar: Occupational pension

My previous job invested about 1% in a work pension, my current job even invests 6% of my yearly wage into a work pension. That’s quite interesting, because as it turns out it can grow to quite high by the time you are 67. The downside here is that the growth is limited by the minimum growth the government says the fund should have, which is pretty much the inflation. Still its a very nice boost you would get at 67. Using the 3% rule it would give me an additional 637 EUR at 67 if I kept working until then.

The Third pillar: private pension

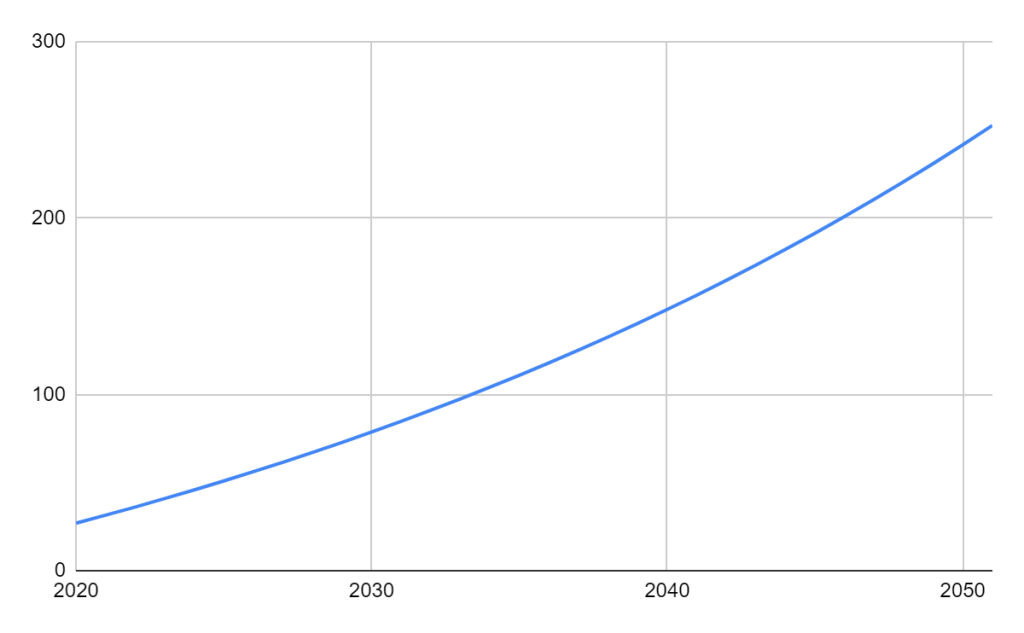

The third pillar includes an extra pension saving plan that the government is giving Tax advantages for. You can save about 1260 EUR per year in an additional pension fund and withdraw 30% from your taxes when you fully invest inthere. The downside is of course that these funds come with considerable costs and the returns are not necessarily higher then what you invest yourself. I do invest fully in these funds because:

- Its only 1260 EUR per year

- The less taxes I pay the better

For the growth of this fund I have assumed a modest 3% growth per year, this together with my yearly investment, gives me the following income at 67, depending of when I stop working:

So another 252 EUR income IF I stay on the job force until 67, giving me a total of 2854 EUR. I would say this is good news. If you are in the workforce, and don’t want to worry to much about retirement and don’t mind to work until 67 then your pension should be high enough to cover your retirement.

Its only when you want to retire before age 67 that you run into a problem. Say you want to retire 10 years earlier I would only be left with 2242 EUR at age 67 plus I would need to find a means to survive for an extra 10 years. It gets more difficult if I wanted to retire at age 47, as then I would only have 1644 EUR at 67 plus a 20 year gap I would need to fill.

The fourth pillar: other investments

This is where my fourth pillar comes in. While officially its part of the third pillar, I prefer to classify this under a second pillar. This is where you store your additional investments in real estate, the stock market or other type of alternative investments.

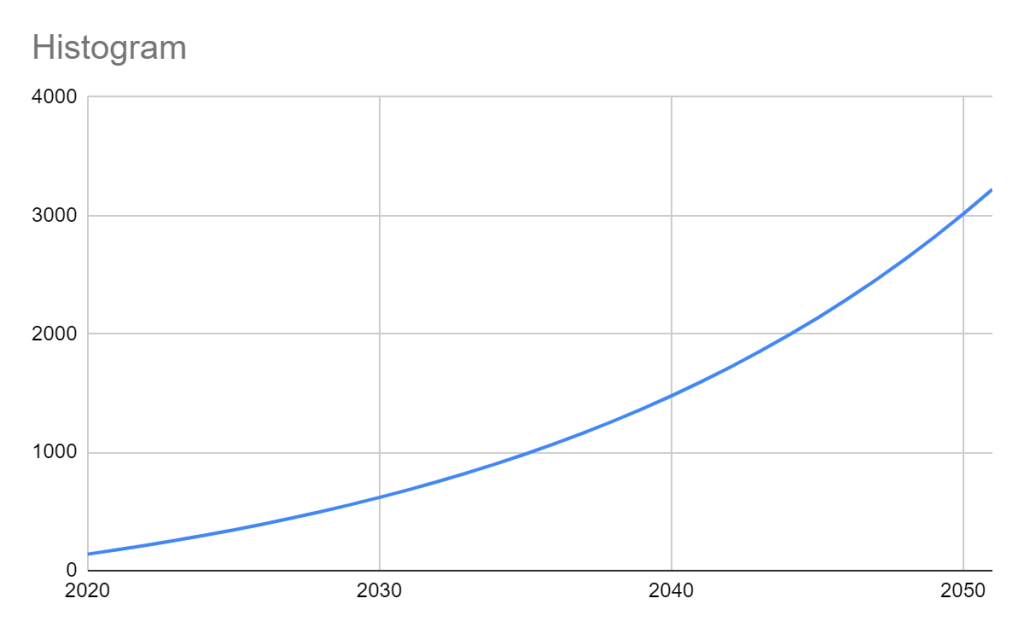

In my case I plan to invest right now about 800 EUR per month in this fourth pillar. I already have 47.000 EUR invested inthere. The good thing about this investment is that you can start withdrawing whenever you like, so you can use this portfolio to bridge the gap between when you retire and the official age of 67.

Now I am assuming a growth of 6% per year for this porfolio and with a monthly investment of 800 EUR per month, the growth cycle looks like this:

Meaning at age of 67 I would be able to withdraw 3220 EUR safely or combined with my other pillars almost 6000 EUR. A pretty wealthy retirement right?

What about retirement before 67?

Right the interesting part. Of course we don’t need 6000 EUR / month to survive. Even half of that would give us a very comfortable wealthy lifestyle.

There is two main things that affect your retirement age: how much you invest, and how much you spend. I really do say how much you invest and not how much you save, as you might be setting aside money for other goals as well. In my case I am also setting aside cash to invest in a house for myself so I am not investing everything that I save. Its important to make this distinction for yourself as I really do consider housing to be important.

But for those who want to retire before 67 (or who knows it could be higher as the government increases this number)

Lets calculate my FIRE number

2019 Recap

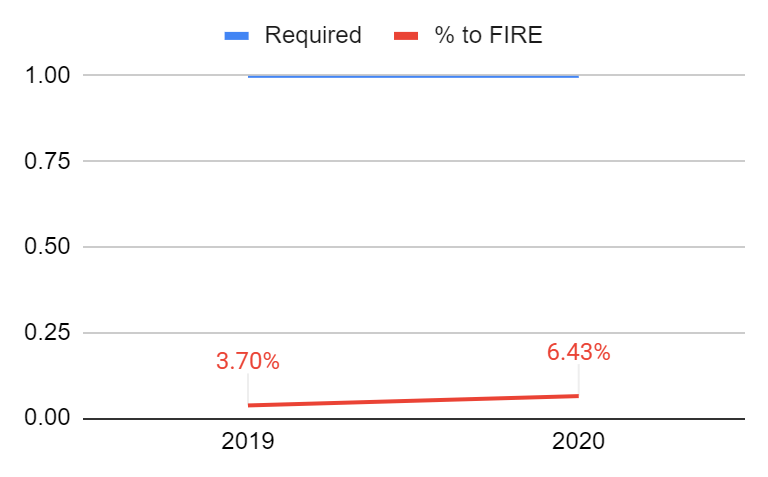

In 2019 I calculated that my FIRE number was 983350 and I was 3.7% along to FIRE. This was based on my current portfolio and a yearly expense in 2019 I had of 29501 EUR!

I did had 29501 EUR expenses in 2019, but also a great income. This year my income dropped with about 20%

It was a pretty huge number, both in terms of expenses as in terms of FIRE number.

What changed in 2020

In 2020 I had about 25000 expenses, so I actually managed to lower my expenses with 4500 EUR! Thats pretty nice. Lowering expenses actually makes it easier to retire. For me I noticed I spend huge amounts on restaurants so just cutting these out already allowed me to save a lot more. Granted Corona did help a lot with that!

I calculated that in 2019 I needed about 27 years until I FIRE’d. This was still better then the 32 years to go to official retirement. My income dropped with about 20% in 2019 because of Covid, however because expenses matter so much in terms of FIRE, I actually managed to cut off another 8 years from my retirement. I am now planned to FIRE in 20 years! Of course I want to try to lower that a few years more. This shows to me that FIRE is not a one set number you calculate once and it stays like that, infact lots of things can influence your FIRE number such as buying a house or having children. Its not because today I can FIRE in 20 years that this will be the same number next year.

I can also say that where in 2019 I was 3% FIRE, I am now 6% FIRE. This is going up slow, but thanks to compound interest the number will accelerate as it grows larger.

How to deal with purchasing a house, children

Well its because of these additional expenses I am only investing a fixed amount. That means higher saving rate does not necessarily lower my retirement age. I invest a fixed amount of 800 EUR in the stock market every month. Once I bought my house then I will consider to increase this number, but I expect it to be fixed in 2021.

Additionally I am slowly starting a house-saving portfolio. So far I put money I saved for a house in the money market, but I realized that the hunt could take longer then expected and then its good to be covered somewhat for inflation. It remains risky to do something like that because it might be cash I need on the short term, but I found that keeping it in money market is just as Risky, as the prices of houses go up and the value of cash goes down. To limit the risk I am moving the cash with about 2000 EUR per month from money market to the stock market. More about that in my December portfolio update!

Interested to follow my progress? Follow me and join me on my Roadtrip to Financial Independence!

Love the blog, Roadtrip to FIRE! Congrats on lowering your # of years until FI! Greetings from the U.S. It’s very interesting to see the different kinds of pensions offered in Belgium. I also like your spin on the conventional 4% rule – I may start to implement the 3.5% rule instead too. Keep up the great work!

LikeLike